👑 Ideas For XAUUSD / GOLD

📈 GOLD → Bears are engulfing the market. What's next?

———————————————

GOLD is hit by a strong wave of selling on optimistic fundamental data in the US market. A takeover is forming on the chart, which clearly makes traders panic.

📈 GOLD → Bears are engulfing the market. What's next?

———————————————

GOLD is hit by a strong wave of selling on optimistic fundamental data in the US market. A takeover is forming on the chart, which clearly makes traders panic.

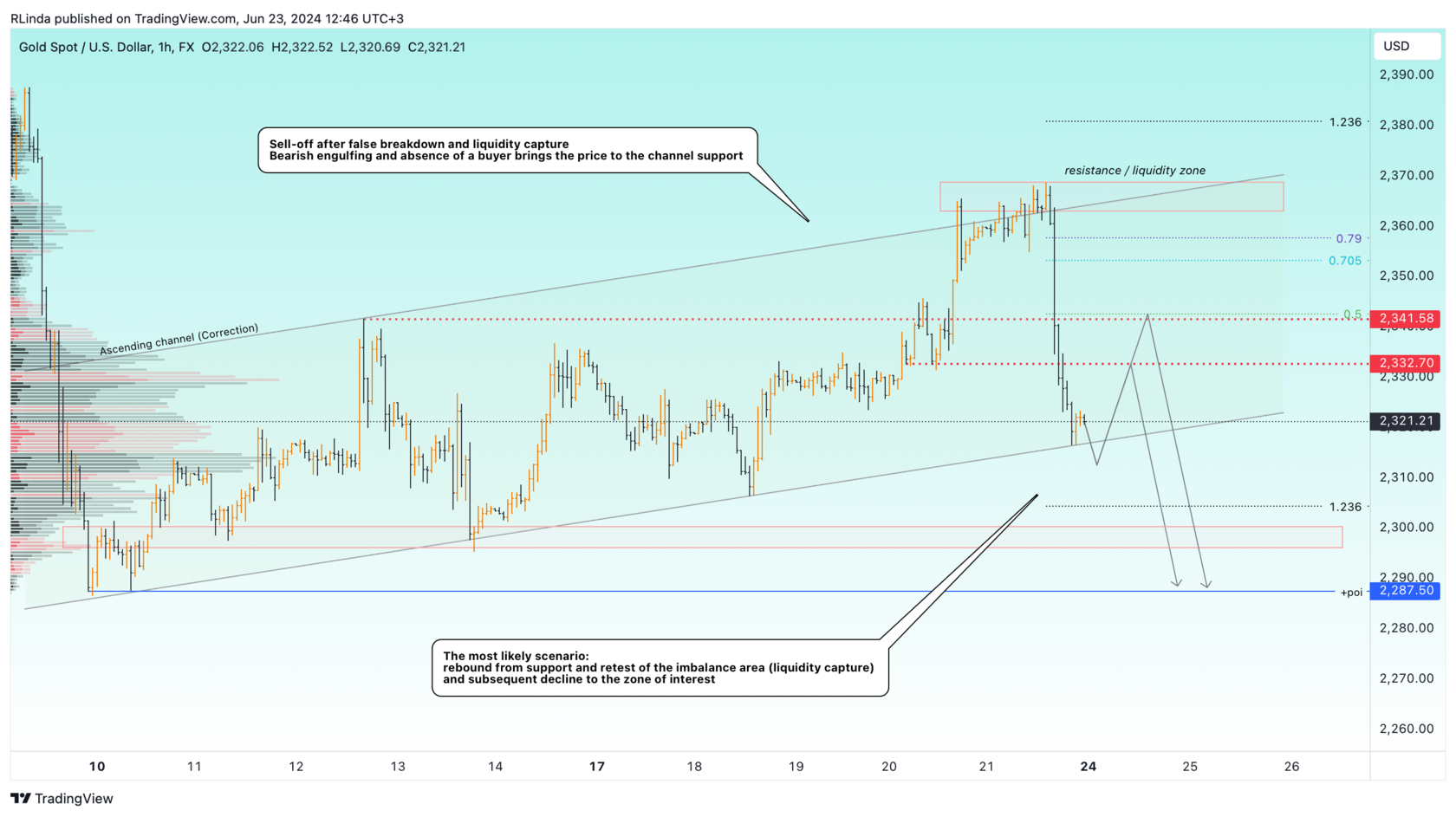

Technically, buyers who showed interest in the metal, which started the strengthening phase from the middle of the month got under liquidation. The sellers are not ready to let the price go beyond 2350-2360 and staged a bearish rally, energized by the fundamental background, which sharply strengthened towards the already bullish dollar

Geopolitical tensions are still at a high level, the reason for this: rumors that the Israeli army approved an offensive against Lebanon.

Toward the end of last week, the dollar both looked and continues to look quite strong, on the back of upbeat S&P Global Manufacturing PMI data. The index rose to 51.7 in the June estimate from 51.3 in May, while the services PMI rose to 55.1 from 54.8, showing continued expansion of private sector business activity at a rapid pace.

Traders are awaiting U.S. GDP to be released on Thursday and on Friday the BEA will release PCE price index data for May, the Fed's preferred measure of inflation.

Toward the end of last week, the dollar both looked and continues to look quite strong, on the back of upbeat S&P Global Manufacturing PMI data. The index rose to 51.7 in the June estimate from 51.3 in May, while the services PMI rose to 55.1 from 54.8, showing continued expansion of private sector business activity at a rapid pace.

Traders are awaiting U.S. GDP to be released on Thursday and on Friday the BEA will release PCE price index data for May, the Fed's preferred measure of inflation.

Resistance levels: 2325, 2332, 2340, 2355

Support levels: 2315, 2305, 2290

Overall, traders may try to buy back some of Friday's decline from local bullish channel support and test the resistance and liquidity area of 2332-2340. But a number of technical and fundamental patterns point to a negative backdrop, and this could generally signal a continuation of the decline after a small correction. Active selling may intensify with a downward breakout of 2316-2320 level

Support levels: 2315, 2305, 2290

Overall, traders may try to buy back some of Friday's decline from local bullish channel support and test the resistance and liquidity area of 2332-2340. But a number of technical and fundamental patterns point to a negative backdrop, and this could generally signal a continuation of the decline after a small correction. Active selling may intensify with a downward breakout of 2316-2320 level