👑 Ideas For XAUUSD / GOLD

📈 GOLD → The sideways movement continues. What's going on?

➖➖➖➖➖➖➖➖➖

GOLD continues to be in global and local sideways movement, which is already annoying. The difficulty of trading lies in the fact that it is more difficult to identify strong zones to enter positions than in a trending market. It is allowed to trade from strong borders or zones, otherwise the market will simply tear up

📈 GOLD → The sideways movement continues. What's going on?

➖➖➖➖➖➖➖➖➖

GOLD continues to be in global and local sideways movement, which is already annoying. The difficulty of trading lies in the fact that it is more difficult to identify strong zones to enter positions than in a trending market. It is allowed to trade from strong borders or zones, otherwise the market will simply tear up

Technically, gold continues to push up to the 2048 resistance. After the false breakdown, there is no fall and we see that the price is slowly but approaching the boundary, but at the same time volumes continue to decline. Or, hidden accumulation of potential is formed and if the price continues slow approach to 2048.7 in the future, the level may be broken soon. But it is too early to say about it. The price makes a false breakdown of 2048.8 and on the retest makes it clear that bears are not letting up yet. On the background of the news, the price may head towards trend support, either from 2048.8 (after another retest), or after a break of 2040, as there are no local reasons for growth beyond 2048.8 at the moment.

Support levels: 2039.4, 2030.9, 2020.8

Resistance levels: 2048.8, 2058.3

There are still some important news ahead, most likely the market will not change much, except for some highly volatile movements, but in general the price will remain in a range, probably until tomorrow's NFP

Support levels: 2039.4, 2030.9, 2020.8

Resistance levels: 2048.8, 2058.3

There are still some important news ahead, most likely the market will not change much, except for some highly volatile movements, but in general the price will remain in a range, probably until tomorrow's NFP

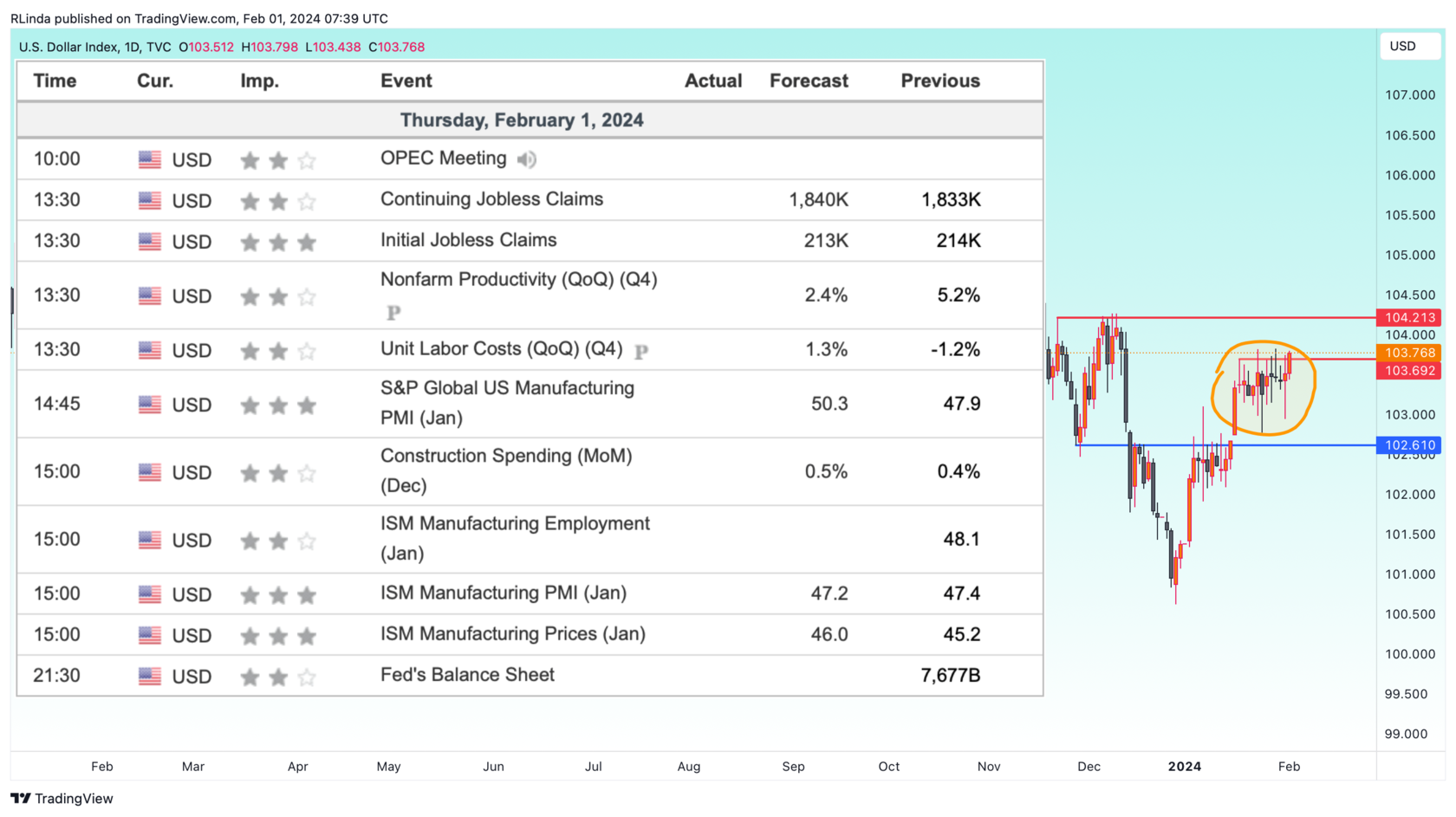

Also not insignificant news ahead of spotty NonFarm Payrolls. It is worth paying attention to the indicators of the following news:

13:30 GMT - Initial Jobless Claims (pending data at the same level)

13:30 GMT - Nonfarm Productivity (bullish)

14:45 GMT - S&P Global US Manufacturing PMI (Analysts expect bullish data).

15:00 GMT - ISM Manufacturing Employment

15:00 GMT - ISM Manufacturing PMI (Analysts expect bearish data)

15:00 GMT - ISM Manufacturing Prices (Analysts expect bullish data)

21:30 GMT - Fed's Balance Sheet (Balance Sheet may decline)

The more the actual data differs from the expected data, the stronger the market reaction will be).

Yesterday, Powell said:

- Rate to remain unchanged at 5.5%

- Fed will continue further balance sheet reduction as planned

- The Fed no longer views stronger economic growth as a problem for monetary policy and believes that weak economic growth is no longer necessarily needed to reduce inflation

- It is too early to say that the Fed has achieved a soft landing for the economy

And. Important:

Fed likely won't cut rate in March as more confidence in a sustained decline in inflation is needed

So, the dollar, in the long run, may still rise.

13:30 GMT - Initial Jobless Claims (pending data at the same level)

13:30 GMT - Nonfarm Productivity (bullish)

14:45 GMT - S&P Global US Manufacturing PMI (Analysts expect bullish data).

15:00 GMT - ISM Manufacturing Employment

15:00 GMT - ISM Manufacturing PMI (Analysts expect bearish data)

15:00 GMT - ISM Manufacturing Prices (Analysts expect bullish data)

21:30 GMT - Fed's Balance Sheet (Balance Sheet may decline)

The more the actual data differs from the expected data, the stronger the market reaction will be).

Yesterday, Powell said:

- Rate to remain unchanged at 5.5%

- Fed will continue further balance sheet reduction as planned

- The Fed no longer views stronger economic growth as a problem for monetary policy and believes that weak economic growth is no longer necessarily needed to reduce inflation

- It is too early to say that the Fed has achieved a soft landing for the economy

And. Important:

Fed likely won't cut rate in March as more confidence in a sustained decline in inflation is needed

So, the dollar, in the long run, may still rise.