💡Ideas For GBPUSD 🇬🇧🇺🇸

📈 GBPUSD → The rallies in GBP continue. Falling to 1.26?

➖➖➖➖➖➖➖➖➖

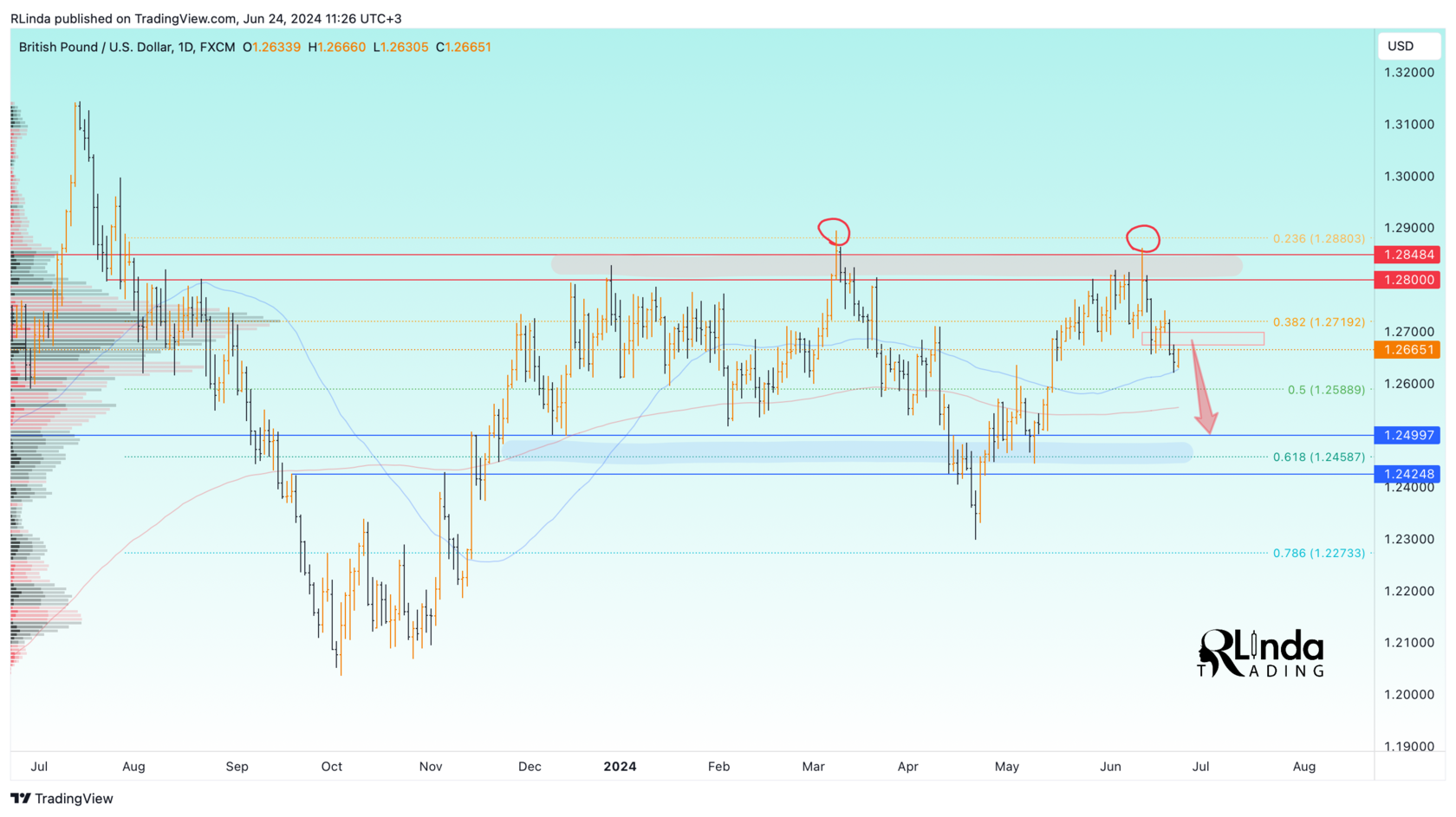

GBPUSD on Friday updates the local low and confirms the bearish nature of the market. Since the opening session traders have been trying to buy back some of the decline and are heading towards the liquidity zone, from which bears may intensify selling

📈 GBPUSD → The rallies in GBP continue. Falling to 1.26?

➖➖➖➖➖➖➖➖➖

GBPUSD on Friday updates the local low and confirms the bearish nature of the market. Since the opening session traders have been trying to buy back some of the decline and are heading towards the liquidity zone, from which bears may intensify selling

Traders increased selling in GBP to a 16-month high amid expectations that the Central Bank of England will start cutting interest rates sooner than the US Fed. Investors are expecting the GDP of both countries (UK and US) on Wednesday and Thursday. This will help to form a medium-term strategy.

Technically, price is heading towards the 1.270 zone of interest (psychological area), which previously played the underlying consolidation support. A retest and capture of the liquids could change the imbalance in the market, which could lead to an intensified sell-off from the said area

Resistance levels: 1.27, 1.275

Support levels: 1.26, 1.257

The dollar index looks stronger than the pound sterling, which continues to weaken due to fundamental reasons. The Feds are not yet ready to take premature action, which generally determines a negative fundamental background for the currency pair.

Technically, price is heading towards the 1.270 zone of interest (psychological area), which previously played the underlying consolidation support. A retest and capture of the liquids could change the imbalance in the market, which could lead to an intensified sell-off from the said area

Resistance levels: 1.27, 1.275

Support levels: 1.26, 1.257

The dollar index looks stronger than the pound sterling, which continues to weaken due to fundamental reasons. The Feds are not yet ready to take premature action, which generally determines a negative fundamental background for the currency pair.