👑 Ideas For #XAUUSD / #GOLD

📈 Is it worth going up against knives? No trading history

———————————————

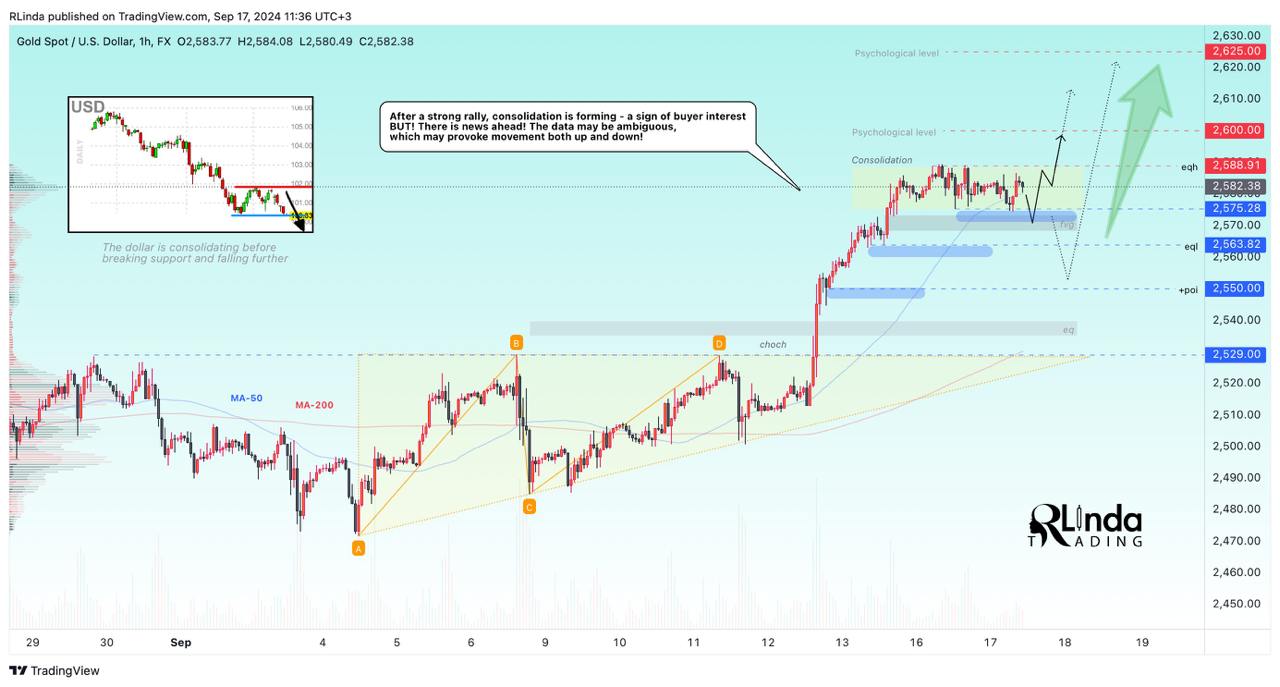

GOLD is consolidating after a rally - a positive sign of an interested buyer. The focus is on the resistance at 2589, as well as on the lower boundary of consolidation ahead of the data on retail prices

In the short (mid) term, gold may form a small correction before a further rally, which will be triggered by lower interest rates. BUT! A 0.5% decline will be a strong signal for the dollar to fall and gold to rise, but a 0.25 decline will be partly disappointing information for investors who may react rather unpredictably (if there is a negative market reaction, it will be short-term as the overall tone of the markets is set by the actual rate cut cycle).

Later today, the US retail sales report will be released, which may give a short-term impact in the market before the main event of September, tomorrow....

Resistance levels: 2588, 2600, 2615, 2625

Support levels: 2575, 2563, 2500

At the moment it is possible to trade from the borders of the consolidation range. But high volatility on the background of news can provoke a breakout of this or that border. Accordingly, the resistance breakthrough may cause the continuation of the rally to 2610-2625. Break of support will send the price to liquidity zones before further growth

📈 Is it worth going up against knives? No trading history

———————————————

GOLD is consolidating after a rally - a positive sign of an interested buyer. The focus is on the resistance at 2589, as well as on the lower boundary of consolidation ahead of the data on retail prices

In the short (mid) term, gold may form a small correction before a further rally, which will be triggered by lower interest rates. BUT! A 0.5% decline will be a strong signal for the dollar to fall and gold to rise, but a 0.25 decline will be partly disappointing information for investors who may react rather unpredictably (if there is a negative market reaction, it will be short-term as the overall tone of the markets is set by the actual rate cut cycle).

Later today, the US retail sales report will be released, which may give a short-term impact in the market before the main event of September, tomorrow....

Resistance levels: 2588, 2600, 2615, 2625

Support levels: 2575, 2563, 2500

At the moment it is possible to trade from the borders of the consolidation range. But high volatility on the background of news can provoke a breakout of this or that border. Accordingly, the resistance breakthrough may cause the continuation of the rally to 2610-2625. Break of support will send the price to liquidity zones before further growth